What’s new at Coface Business Information

At Coface Business Information, we’ve recently made several improvements to our platform and services. We listened to the feedback you’ve shared and focused on what matters most: broader data, simpler workflows with fewer steps, and greater transparency in company profiles.

From expanding our global data coverage through the acquisition of Cedar Rose, to integrating shareholder and management information directly into company views, each change is designed to remove friction and improve customer experience. We have also introduced a new Compliance Screening add-on in Urba360, powered by LSEG, to support more rigorous due diligence.

These changes aim to support core use cases — whether you're assessing risk, managing compliance, or working toward faster, more informed decisions.

Expanding global reach: the acquisition of Cedar Rose

We’re pleased to announce the acquisition of Cedar Rose, a leading provider of business intelligence with deep expertise in the MENA (Middle East and North Africa) region and emerging markets. This acquisition expands our data footprint and improves our ability to support cross-border decision-making.

Cedar Rose brings structured data licensing, entity hierarchy mapping, and integration capabilities that help clients manage ownership structures and compliance requirements more effectively.

Why it matters

This acquisition strengthens our regional coverage and adds new capabilities for our customers:

- Expanded data for several African and MENA countries, sourced from official government records. Initial release includes UAE, Egypt, and Saudi Arabia, with Lebanon, Bahrain, Jordan, Kuwait, Oman, and Qatar to follow.

- Coverage will extend to 42+ additional countries, reaching over 50 million companies.

- Improved access to structured data for faster due diligence

- Enhanced visibility into complex ownership networks

- Direct access to MENA intelligence via our dedicated center

Access to trustworthy company data in the MENA region is often difficult, with limited transparency and fragmented sources. By combining Cedar Rose’s expertise with Coface’s global platform, we’re making this information easier to access, more structured, and directly usable. This means you can confidently navigate markets that were previously hard to analyze, saving time and reducing uncertainty in your decisions.

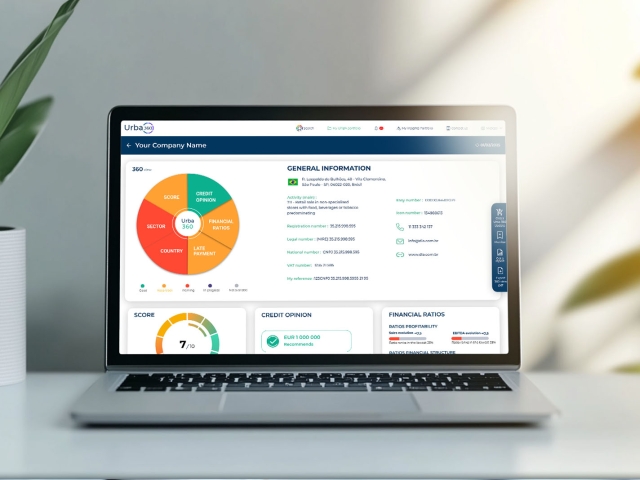

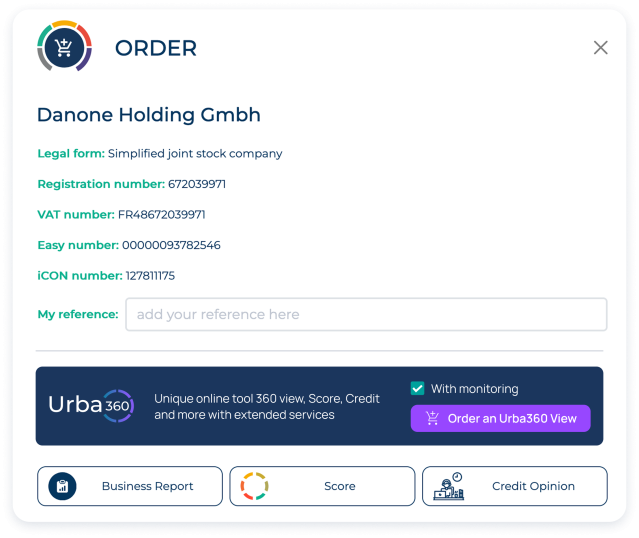

Monitoring made simple in Urba360

Monitoring is a critical part of risk management. It allows you to stay informed about changes in a company’s status and, financial health. Previously, monitoring could only be activated after placing an initial order, adding an extra step to your workflow.

We’ve now streamlined the process: You can order and activate monitoring in a single step, directly from the start in Urba360.

What’s improved:

- One-step ordering and monitoring

- Faster access to relevant updates

- Greater efficiency for procurement and compliance teams

This change is especially valuable for users managing large volumes of company checks or working under tight timelines.

It also lays the groundwork for upcoming enhancements to the portfolio view feature.

Monitoring continues to be a core part of the value we deliver, and this update makes it easier to use from day one. Importantly, monitoring is not mandatory — you decide when and how to activate it, giving you the flexibility to adapt it to your specific needs.

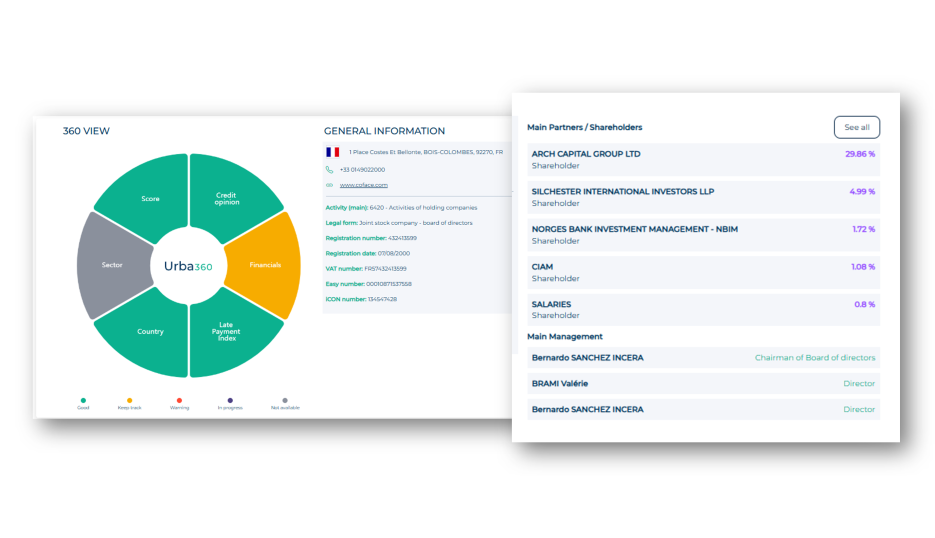

Shareholders & management: now included, automatically

Understanding who owns and runs a company is essential for evaluating governance, transparency, and potential risks. That’s why we’ve enhanced our Urba360 company views to include shareholder and management data — automatically and at no extra cost.

What you’ll see:

- Top 5 shareholders

- Top 3 management members

- Corporate governance data integrated into the company profile

- Exportable insights for reporting and compliance

This update brings direct visibility into ownership and leadership, helping you assess influence, control, and potential conflicts of interest. For deeper analysis, you can open a detailed view or export the data for internal use.

Why it matters:

- Greater transparency in partner and supplier evaluations

- Faster due diligence with no additional requests

- Enhanced confidence in your business decisions

Whether you're onboarding a new supplier or evaluating a potential acquisition, this data helps you move forward with clarity.

Compliance screening in partnership with LSEG

Compliance is no longer just a legal requirement — it’s a strategic imperative. With increasing regulatory scrutiny and growing reputational risks, businesses need tools that help them stay ahead of potential issues.

That’s why we’ve partnered with LSEG (London Stock Exchange Group) to bring into Urba360 as a powerful new add-on.

What it offers:

- AML and KYC verifications powered by global compliance data

- Screening for sanctions, PEPs (Politically Exposed Persons), and adverse media

- Structured, high-quality data backed by 500+ researchers and AI-driven technology

- Entity linkage analysis to reveal hidden connections

- Automated checks for customers, suppliers, and partners

This integration allows you to combine Coface’s financial risk insights with LSEG’s global compliance data.

Business benefits:

- Avoid financial penalties and legal consequences through robust AML/KYC screening

- Support informed decision-making in supplier and credit risk assessments

- Facilitate smoother cross-border transactions

- Demonstrate a proactive stance on ethical business practices

Important note:

This feature is available as an add-on on top of your Urba360 subscription. For access and pricing, please contact your Account Manager.

Each of these enhancements is designed with one goal in mind: to help you make better decisions, faster. Whether you’re a compliance officer, credit analyst, procurement manager, or business development lead, these tools give you the insights you need to operate with confidence.

Together, these updates reflect our ongoing commitment to innovation, transparency, and client success.

Other updates

Changes to Credit Opinion Reports

The @Credit Opinion and Advanced Opinion reports will no longer display the Score or Country Risk Assessment. These insights remain available in Urba360, along with additional analytics.

This change reflects a shift in how risk indicators are accessed. Rather than embedding these metrics in static reports, we are moving into consolidating key insights into Urba360, where they’re continuously updated and presented alongside broader company insights.

If you rely on these reports for decision-making, your Account Manager can guide you on how to access the full set of risk indicators and analytics within Urba360.

Worldwide

Worldwide

France

France

Germany

Germany

United Kingdom

United Kingdom

Italy

Italy

United States

United States

Spain

Spain

Poland

Poland

Romania

Romania

Croatia

Croatia

Australia

Australia

Austria

Austria

Belgium

Belgium

Brazil

Brazil

Bulgaria

Bulgaria

Czech Republic

Czech Republic

Denmark

Denmark

Finland

Finland

Greece

Greece

Hungary

Hungary

India

India

Japan

Japan

Lithuania

Lithuania

Netherlands

Netherlands

New Zealand

New Zealand

Norway

Norway

Serbia

Serbia

Slovakia

Slovakia

South Africa

South Africa

Sweden

Sweden

United Arab Emirates

United Arab Emirates